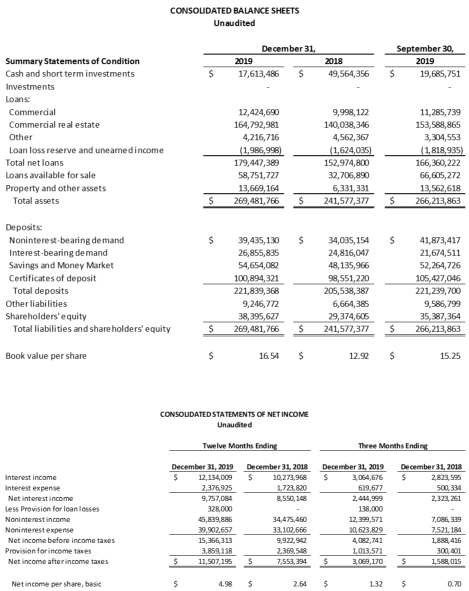

Fourth quarter 2019 net earnings increased 93% to $3.1 million, or $1.32 per common share

Full-year 2019 net earnings increased 52% to $11.5 million, or $4.98 per common share

Annual loan growth of 17% or $26 million, and deposit growth of 8% or $16 million

Annual residential mortgage loan volume of $981 million

SALEM, Ore. – January 24, 2020 – Oregon Bancorp, Inc. (OTCBB: ORBN) (the “Company”), parent company of Willamette Valley Bank, reported net income of $3,069,170 for the fourth quarter of 2019 compared to $1,588,015 during the fourth quarter of 2018. Earnings per share for the quarter were $1.32 compared to $0.70 for the same quarter a year ago. The company also declared a cash dividend of $0.11 per share during December.

Year-to-date net income rose to $11.5 million in 2019, an increase of 52% from 2018 and representing a new high for the Company. Return on average assets for the year reached 4.46% compared to 3.37% in 2018 and return on average equity for the year was 36.42% compared to 29.89% in 2018. Total assets improved from $241 million at December 31, 2018 to $269 million December 31, 2019.

Asset quality remains positive with past due loans equaling 0.67% of total loans and non-performing loans as a percentage of total loans measuring 0.52%. Strong earnings have increased the Company’s ratio of equity to total assets to 14.25%.

“We continue to see good commercial and residential loan demand and increases in deposits have led to balance sheet growth from the prior year,” stated Ryan Dempster, President and Chief Executive Officer. “The Company’s asset quality and capital remain strong and provide a stable foundation for future growth. Earnings continued their upward trend from prior years and remain a leader among peer institutions.”

About Oregon Bancorp, Inc.

Oregon Bancorp, Inc. is the parent company of Willamette Valley Bank (Bank), a community bank headquartered in Salem, Oregon. The Bank operates full-service branches in Salem, Keizer, Silverton, and Albany, Oregon. The Bank also operates Home Loan Centers in Bend, Eugene, Grants Pass, Medford, Portland, Tualatin, and West Linn, Oregon, Vancouver, Spokane, Newport and Yakima, Washington, and Coeur d’Alene and Meridian, Idaho. For more information about Oregon Bancorp, Inc. or its subsidiary, Willamette Valley Bank, please call (503)485-2222 or visit our website at www.willamettevalleybank.com.

Certain statements in this release may be deemed “forward-looking statements”. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from those contained in any forward-looking statement.